However, when it pertains to conserving up for your down payment, you should not always aim for average. The quantity you'll need is going to depend on numerous factors like: Your debt-to-income (DTI) ratio Your credit rating The home loan type you select Your loan provider's particular requirements What grants and resources you can get (for newbie house buyers) Your DTI is the amount of your gross earnings that approaches paying on any debt you're holding.

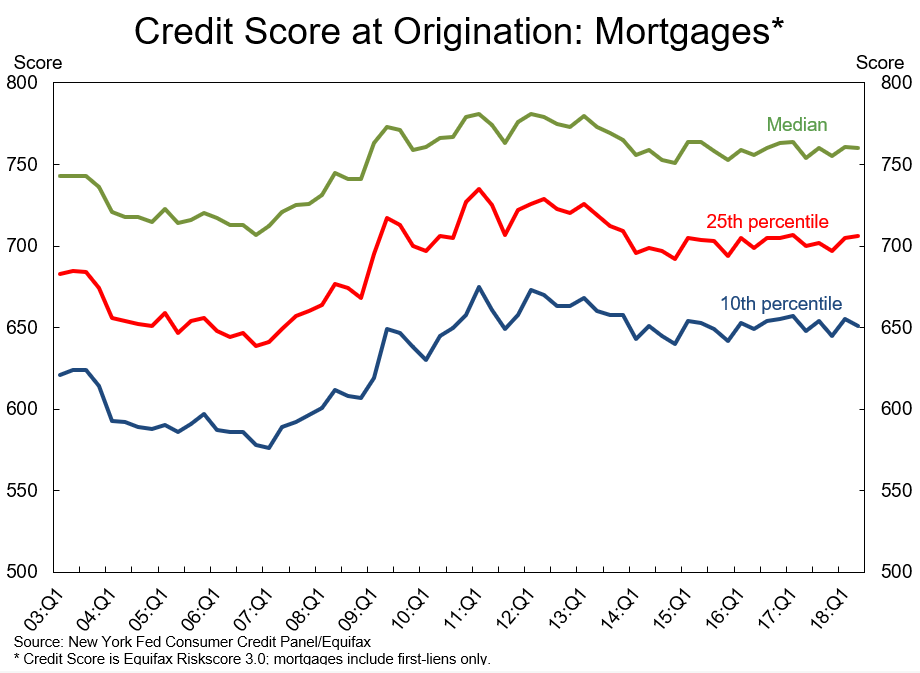

Making a higher deposit might assist your case due to the fact that you won't need to obtain as much cash to buy your house, making your month-to-month payments more manageable. Your credit report can have a big influence on how much you require to put down. If you have outstanding credit, a lender will be more likely to accept a lower deposit because you have actually demonstrated monetary responsibility.

Beyond your personal monetary situation, the type of home loan that you get will impact your required down payment (see the next area for more details). In addition, the particular loan provider that you deal with might have its own guidelines relating to down payments, so you'll have to inquire. Considering that conserving up for a deposit can be a major obstacle to homeownership for numerous, there are grants offered to help cover the cost in addition to other closing expenses.

What Is A Min Number For Mortgages Things To Know Before You Buy

When it concerns adulting, you remain in the major leagues now. You're formally aiming to buy your own home. As a first-time property buyer, it's natural to be wary of the process and drawing up that huge look for your down payment is frightening enough to make your hand shake. So we're debunking the ins and outs of the down payment so you can tackle this major purchase with self-confidence.

You'll typically see the down payment referenced as a percentage of the prices. For instance, a 20 percent down payment on a $300,000 house is equivalent to $60,000 down. If you are, like a lot of people, paying less than 100 percent of the home's rate out of your own pocket, you'll have to obtain the balance of the purchase cost from a lending institution in the type of a mortgage.

With that level of equity, you present yourself as economically stable adequate to be a major purchaser Helpful site to both house sellers and home loan lending institutions. If you put down less than 20 percent, your lender may require you to pay personal home loan insurance, likewise called PMI, which would be added onto your regular monthly mortgage payment.

The Best Guide To Why Do Banks Sell Mortgages To Fannie Mae

Each mortgage business has its own set of requirements when it concerns the size of your deposit, your credit report, your properties and more. Some types of mortgages, such as those backed by the Federal Real Estate Authority (FHA), will take smaller down payments, so be sure to search to find the finest mortgage terms for which you qualify.

Rather, you'll likely wind up paying it in two installments initially as an "earnest cash" payment when you sign the purchase agreement, and a last payment at the closing. The quantity that's paid upfront in earnest cash is a detail you'll define in advance in the purchase contact. Buying an existing home? Anticipate to spend 1 percent to 3 percent of the purchase price in earnest cash.

It doesn't enter into the pocket of the seller straightaway. Instead, you put that cash directly into escrow. An escrow business or officer is a neutral 3rd party who holds onto the payments you make until the deal is finalized. Then, that entity distributes the money to the seller and to everyone else who's owed a piece.

Our How Does Chapter 13 Work With Mortgages Statements

Talk to your representative to learn how and where your payments are being held - what is the current interest rate for mortgages?. Sometimes, even after you and http://lorenzofumg459.iamarrows.com/8-simple-techniques-for-how-to-swap-houses-with-mortgages the seller sign an agreement, the deal falls apart before closing, and you have actually still got cash on the line. Your ability to recover your earnest money and other payments depends on your regional laws, your agreement terms and the factor the sale died.

But you might be able to get it back if The seller decides to take the house off the market. You can't get a mortgage that will allow you to purchase the property. A building assessment turns up a significant problem you didn't understand about. You change your mind about the sale within a pre-determined period.

And your genuine estate agent and loan provider can provide additional insight into the realty laws governing your area. If you're conserving to buy a house, keep this in mind: A down payment isn't the only money you'll need to pony up throughout the procedure - what is the current interest rate for mortgages?. Along the way, you might need to cover some upfront expenditures for processing your home mortgage application, hiring a home inspector and more.

The 7-Minute Rule for How Do Reverse Mortgages Work?

An experienced representative or an online calculator can supply you with a quote of what those costs will total. So make sure you include that quantity together with your deposit in computing your savings objective.

By clicking "See Rates", you'll be directed to our supreme parent company, LendingTree. Based on your creditworthiness, you may be matched with up to 5 different lenders. A deposit on a house is the up-front payment a home buyer need to provide in order to secure the amount that is obtained.

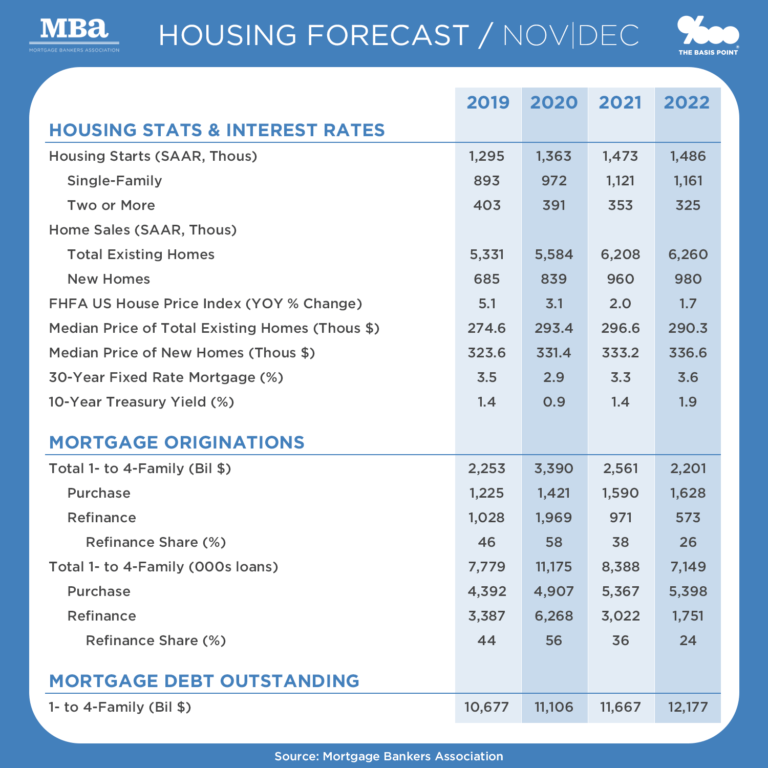

These requirements and costs will differ depending upon your credit rating, home mortgage type, and house value. To assist you understand the expenses of buying a house, we have actually discussed how home loan deposits work. For mortgages offered by banks and cooperative credit union, called "traditional loans," federal government standards need a down payment of at least 3% of a home's purchase cost.

Our What Is The Interest Rate On Mortgages Today PDFs

Houses that cost more than the legal adhering limit on mortgages a figure normally around $424,100 are called "jumbo loans" and include more stringent qualifying requirements, consisting of higher deposits. Government backed FHA loans require deposits of 3. 5%, while VA loans for veterans have no down payment requirements.

5% if FICO rating > 580 10% if FICO rating < 580 Borrowers seeking a low down payment Customers with poor credit ratings VA MortgageGovernment0% Veterans and their partners For both FHA and standard loans, larger down payments will enable lower regular monthly costs. The key distinction in between the 2 types of home loans focuses on the issue of home loan insurance coverage.

Traditional home loans are not backed by the federal government, and they require you to pay for private insurance to cover the expense of default. However, traditional lending institutions waive insurance fees if deposits surpass 20%, and permit you to stop paying home loan insurance coverage as soon as 20% of your home loan balance is paid down - how do mortgages work in monopoly.

The Ultimate Guide To How Browse around this site Do Reverse Mortgages Work Example

The size of your home mortgage down payment impacts your loan quantity, interest payments and home loan insurance coverage costs. A bigger down payment suggests that you'll have to take a bigger chunk out of your savings, but will allow you to secure a smaller sized loan amount causing lower overall expenses.